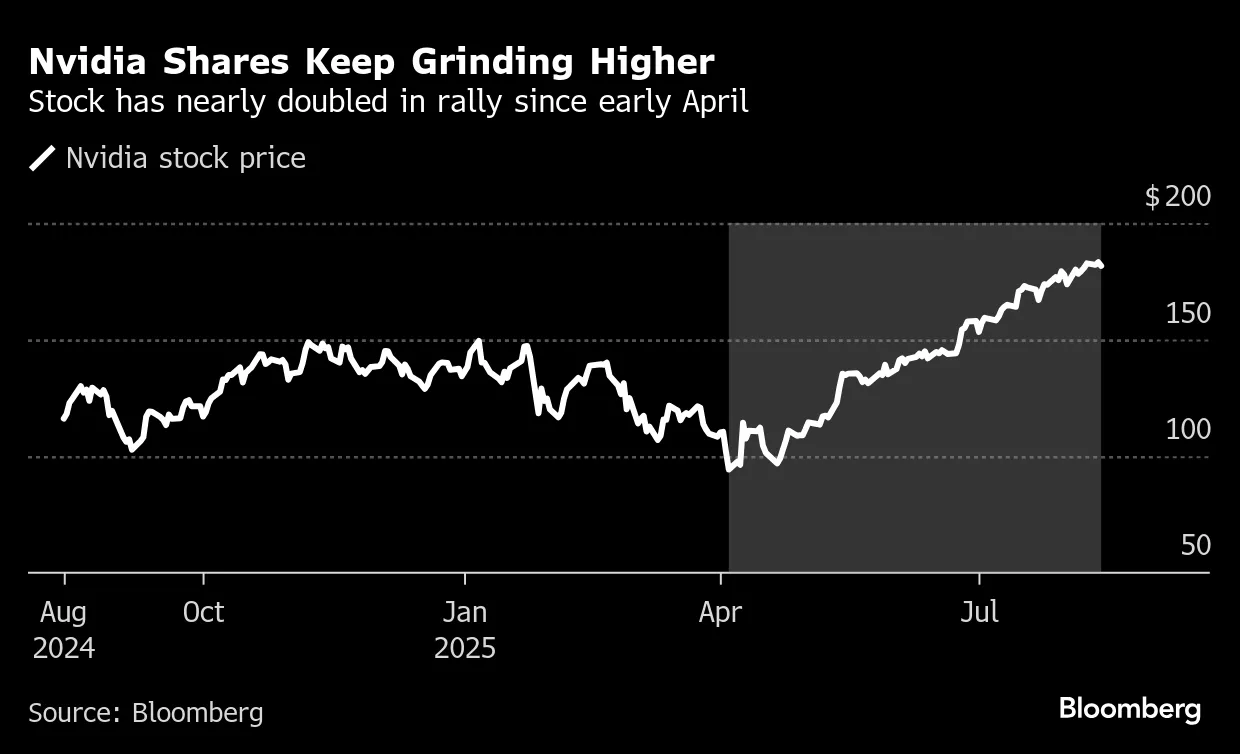

Investors in Nvidia are brushing off concerns over the so-called “Trump Tax,” a regulatory measure impacting U.S.-listed companies with significant exposure to foreign income. Despite the new tax implications, Nvidia shares remain resilient, buoyed by the surging demand for artificial intelligence (AI) technologies. Analysts and market participants view the policy as a minor factor relative to the company’s dominant position in AI chips and its role in powering next-generation machine learning applications.

Understanding the Trump Tax

The “Trump Tax” refers to legislation aimed at taxing foreign-derived intangible income and certain overseas revenues of U.S. corporations. While the measure was designed to increase tax revenues and encourage domestic investment, its direct impact on Nvidia is relatively limited. The company’s substantial domestic R&D, high-margin GPU sales, and strong presence in AI infrastructure mitigate the effect of the tax.

For investors, the Trump Tax is largely considered a manageable cost rather than a threat to Nvidia’s growth trajectory. Analysts note that Nvidia’s ability to command premium pricing for its AI-focused GPUs and secure long-term contracts with hyperscale cloud providers offsets any incremental tax liabilities.

Nvidia and the AI Gold Rush

The primary driver of investor confidence is Nvidia’s central role in the AI boom. Its GPUs are essential for training large language models, powering data centers, and enabling high-performance computing. Corporate, government, and research institutions are increasingly relying on Nvidia hardware to accelerate AI workloads, creating a sustained surge in demand.

Revenue from AI-related products now represents a significant portion of Nvidia’s business, and market forecasts suggest continued growth as generative AI adoption expands across industries. This growth narrative overshadows minor fiscal concerns like the Trump Tax, as investors focus on the long-term earnings potential tied to AI.

Investor Sentiment and Market Resilience

Despite periodic headlines about regulatory or tax-related developments, Nvidia shares have shown remarkable resilience. Investor sentiment remains strongly positive due to several factors:

- Market Leadership: Nvidia dominates the GPU market for AI and high-performance computing, giving it pricing power and brand recognition.

- Strategic Partnerships: Collaborations with leading cloud providers and AI startups reinforce its ecosystem and revenue streams.

- R&D Investment: Aggressive investment in next-generation chips ensures Nvidia remains at the forefront of technological innovation.

For portfolio managers and retail investors alike, these factors outweigh the potential costs imposed by the Trump Tax, keeping confidence elevated in Nvidia’s AI-driven growth story.

Broader Implications for the Tech Sector

Nvidia’s ability to absorb new tax measures without significant investor concern reflects a broader trend in the tech sector. Companies with critical intellectual property, scalable infrastructure, and dominant market positions are better equipped to weather regulatory changes. The situation also highlights how macro-level policy shifts, such as the Trump Tax, can have differential impacts depending on a company’s business model and market positioning.

Conclusion

While the Trump Tax may influence Nvidia’s bottom line marginally, the company’s dominant position in the AI sector, strong demand for GPUs, and robust growth prospects leave investors largely unconcerned. Nvidia exemplifies how leading tech companies can navigate regulatory changes while benefiting from transformative trends such as artificial intelligence. For market participants, the focus remains squarely on AI-driven revenues, innovation, and long-term strategic positioning—factors that continue to outweigh any minor tax headwinds.