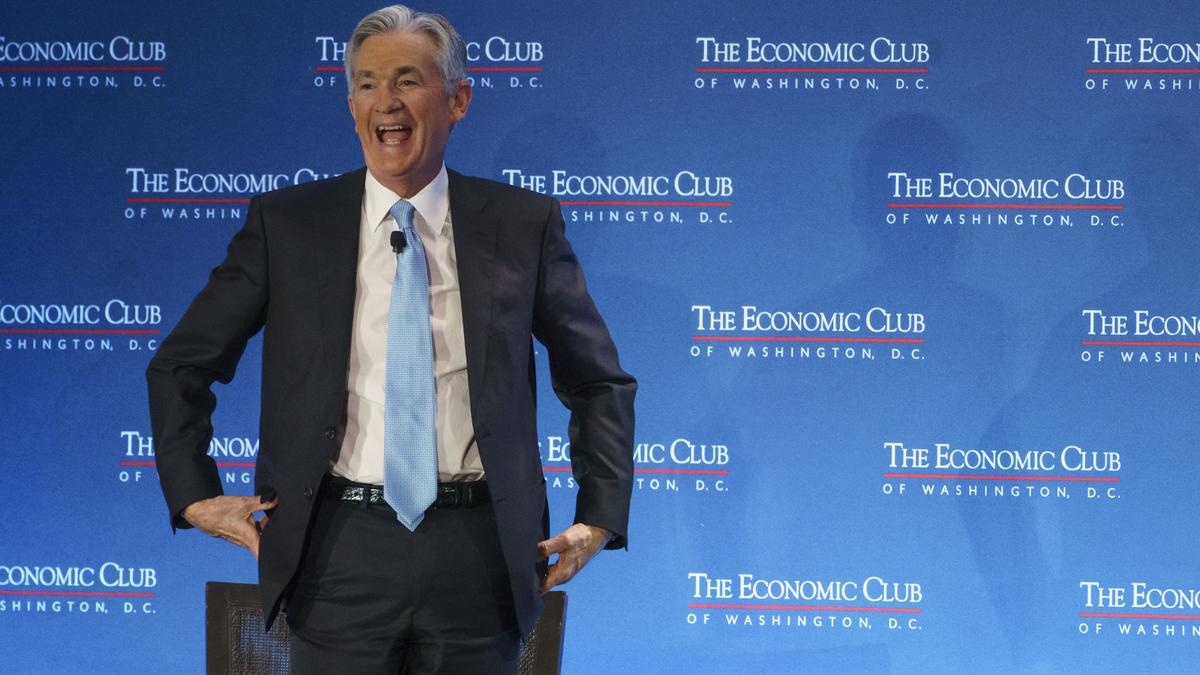

After days of uncertainty and back-to-back losses, Wall Street finally found the rally signal it was hoping for. The S&P 500 Index surged 1.5% on Friday, snapping a five-session losing streak and finishing just shy of its all-time record. The turnaround came as investors closely parsed Federal Reserve Chair Jerome Powell’s latest remarks, which suggested that policymakers may be nearing the end of their rate-hiking cycle.

A Relief Rally Fueled by Clarity

Markets have been gripped by volatility in recent weeks as investors weighed strong economic data against fears that the Federal Reserve could keep interest rates elevated for longer. Powell’s comments, however, struck a more balanced tone than many expected. While reaffirming the Fed’s commitment to taming inflation, he also acknowledged signs of cooling in both price pressures and the labor market—signals that rate cuts could be on the horizon if trends continue.

For Wall Street, that was enough to reignite optimism. The S&P 500 posted its sharpest one-day gain in weeks, led by a surge in technology and growth-oriented stocks. The Dow Jones Industrial Average and Nasdaq Composite also rallied, each climbing more than 1%.

Investor Sentiment Reverses Course

The rebound reflects how sensitive market sentiment has become to the Fed’s forward guidance. Only days earlier, traders had begun pricing in the risk of another rate hike, sparking a selloff. Powell’s recognition of “progress” against inflation offered a more hopeful narrative: that the central bank could achieve a so-called “soft landing”—slowing the economy enough to control inflation without triggering a deep recession.

Bond markets echoed the optimism. Treasury yields, which had been marching higher amid hawkish fears, eased after Powell’s speech. The dollar also weakened slightly, a sign that investors are betting the Fed may not need to remain as aggressive.

Tech Leads the Charge

Technology stocks, which are particularly sensitive to interest rate expectations, were the biggest winners of the day. Heavyweights like Apple, Microsoft, and Nvidia all posted strong gains, helping lift the broader indexes. With lower borrowing costs on the horizon, investors see renewed upside for growth sectors that thrive on cheap capital and long-term earnings potential.

What Comes Next

Despite the rally, analysts caution that the path ahead remains delicate. Inflation, though cooling, is still above the Fed’s 2% target. Any surprise data showing prices heating up again could reignite volatility. Moreover, global risks—from China’s uneven recovery to geopolitical tensions—remain potential headwinds for markets.

Still, for now, Wall Street is taking Powell’s latest message as a green light. The rally has brought the S&P 500 within striking distance of record territory, underscoring just how eager investors are for a shift in the Fed’s stance.

The Bigger Picture

The episode highlights a recurring theme of the past two years: markets live and die by the Fed’s words. With inflation showing gradual improvement, Powell’s remarks suggest a turning point may be near. If the central bank manages to navigate this balancing act, the long-feared hard landing could give way to a period of renewed growth—one that equity markets are already starting to price in.