The price of gold has been climbing steadily in recent months, breaking new all-time highs and fueling speculation among investors, analysts, and central banks. But according to Goldman Sachs, the surge is far from a speculative bubble—in fact, the bank believes gold may just be getting started.

- Why Goldman Is Bullish on Gold

- 1. Central Banks Hoarding Gold

- 2. Fear of Inflation—Even After Rate Cuts

- 3. Debt Crisis Concerns

- 4. Geopolitical Tension and War Risk

- Could History Repeat Itself?

- Price Forecast: $3,000 Gold in Sight?

- Wall Street Shifts from Crypto Back to Gold

- Who Is Buying the Gold?

- Silver and Copper Also in Play

- Will Governments Try to Fight the Gold Rally?

- The Bottom Line

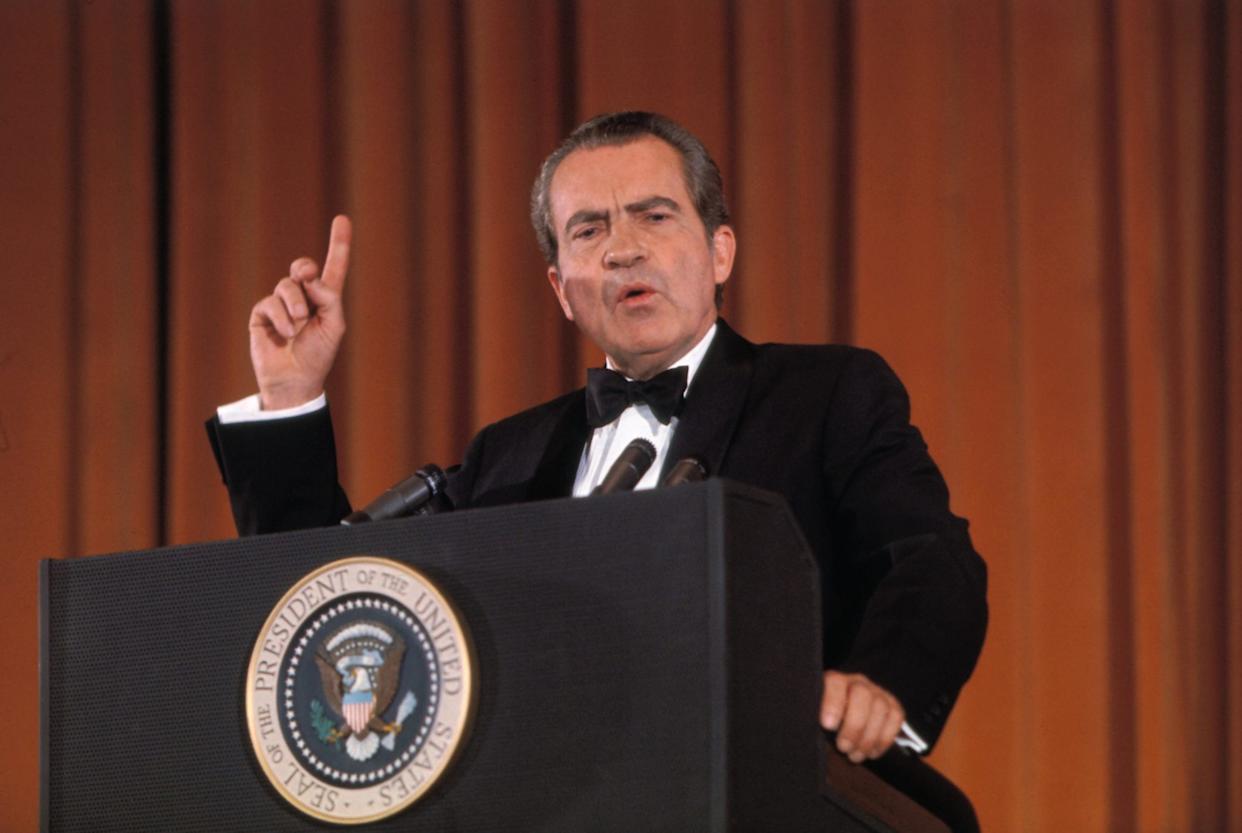

In a new commodities outlook report, Goldman says the U.S. could experience a repeat of the 1970s-style gold explosion, when inflation, currency uncertainty, and geopolitical shocks drove the precious metal’s price up nearly 10-fold after President Richard Nixon ended the gold standard in 1971.

“The demand for gold is not just hype,” Goldman analysts wrote. “We are witnessing a structural shift in how nations and long-term investors view monetary hedges and financial safety.”

Why Goldman Is Bullish on Gold

Goldman Sachs’ bullish case is driven by four major catalysts:

1. Central Banks Hoarding Gold

Central banks around the world are accumulating gold reserves at the fastest pace in more than 50 years.

- China, Turkey, Poland, India, and Singapore have dramatically increased gold purchases.

- Central bank gold buying rose over 1,000 metric tons in 2023, near a historic record.

- This trend reflects a growing shift away from the U.S. dollar as a reserve currency.

2. Fear of Inflation—Even After Rate Cuts

Goldman warns inflation could “rebound structurally higher” due to:

- Trillion-dollar U.S. deficits

- Commodity supply constraints

- De-globalization and reshoring

- Higher labor costs

Historically, gold performs well during inflationary waves, just as it did in the Nixon, Carter, and early Reagan years.

3. Debt Crisis Concerns

The U.S. is now carrying over $35 trillion in national debt, with interest payments rising faster than tax revenues. Goldman argues this could lead to:

- Dollar weakening

- Declining investor confidence in U.S. fiscal strength

- Renewed interest in hard assets like gold

4. Geopolitical Tension and War Risk

With two major wars—Ukraine and the Middle East—and rising tensions between the U.S. and China, global instability is pushing both governments and private investors into gold as a safe-haven asset.

Could History Repeat Itself?

Goldman specifically draws parallels to the Nixon era, when U.S. monetary policy was unstable and inflation surged. After Nixon suspended dollar convertibility into gold in 1971:

| Year | Gold Price (per ounce) |

|---|---|

| 1971 | $35 |

| 1974 | $183 |

| 1980 | $850 |

Gold prices rose 2,328% in less than a decade.

Goldman believes the current macro environment mirrors that era—high deficits, rising labor costs, and declining global trust in the U.S. dollar.

“We see conditions forming for a long-term re-rating of gold as a strategic monetary asset,” Goldman wrote.

Price Forecast: $3,000 Gold in Sight?

Gold is currently trading near $2,350 per ounce, but Goldman believes it could rise to $3,000 within 12–18 months, driven by institutional and sovereign buying.

Some hedge funds are more aggressive:

- Bridgewater Associates says gold could reach $4,000.

- Bank of America has a high target of $3,500.

- Peter Schiff says $5,000 is “inevitable.”

Wall Street Shifts from Crypto Back to Gold

Interestingly, Goldman notes a rotation from Bitcoin back to gold among institutional investors. While Bitcoin is still marketed as “digital gold,” its volatility has limited adoption among pension funds, governments, and conservative wealth institutions.

“Gold remains uniquely trusted in crisis scenarios,” Goldman says. “It has 5,000 years of credibility—and no counterparty risk.”

Who Is Buying the Gold?

Gold demand has become global and multi-sector.

| Buyer Category | Motive |

|---|---|

| Central Banks | Reduce dollar exposure |

| Sovereign Wealth Funds | Hedge geopolitical risk |

| Hedge Funds | Inflation hedge |

| Pension Funds | Safe long-term diversification |

| Retail Investors | Fear of recession |

Silver and Copper Also in Play

Goldman notes that silver may outperform gold if industrial demand rises. Silver has dual uses—as both a monetary metal and a key component in solar panels, electronics, and EVs.

Goldman set a silver target of $38/oz in a bullish scenario.

Will Governments Try to Fight the Gold Rally?

Some analysts warn that if gold prices rise too quickly, governments may tighten regulation on gold trading or pressure central banks to slow purchases—just as the U.S. did between 1933 and 1975 when private gold ownership was partially restricted.

But today, with China, Russia, and India dominating demand, Western governments have less control over gold markets.

The Bottom Line

Goldman Sachs is clear: gold demand is real, long-term, and rising. The bank sees gold evolving from a speculative asset into a global monetary hedge of last resort.

As de-dollarization accelerates and economic uncertainty grows, gold could be entering a new supercycle—just like it did in the Nixon era.

“The market is underestimating the long-term monetary implications of global reserve diversification,” Goldman concludes. “Gold is entering a new era.”