Southeast Asia’s tech sector — once hailed as the world’s fastest-growing digital economy — is now facing one of its toughest moments in a decade. Funding has dropped sharply, valuations have cooled, hiring has slowed, and several well-known startups are restructuring or shutting down. From Jakarta to Singapore, Kuala Lumpur to Ho Chi Minh City, the region’s formerly unstoppable surge has been tempered by global macro uncertainty, rising interest rates, and the aftereffects of pandemic-era overinvestment.

- 1. Funding Has Tightened Significantly

- 2. Valuations Have Reset

- 3. Market Leaders Are Consolidating

- 4. Global Macroeconomic Pressure

- 1. The Region’s Macro Fundamentals Are Still Strong

- 2. Correcting Excesses Is Healthy

- 3. Startup Talent Is Better Than Ever

- 4. Investors With Patient Capital Are Leaning In

- 1. Enterprise SaaS and B2B Tech

- 2. Fintech for Underserved Markets

- 3. Climate and Energy Transition

- 4. AI Tailored for Emerging Markets

- 5. Healthtech and Edtech

- Tough markets force founders to:

- “This is the moment when true builders emerge,” Pai said.

Yet, amid the gloom, a different narrative is quietly emerging — one that sees this downturn not as a collapse but as a recalibration. And one prominent voice is making the case that Southeast Asia’s long-term trajectory is far more promising than the headlines suggest.

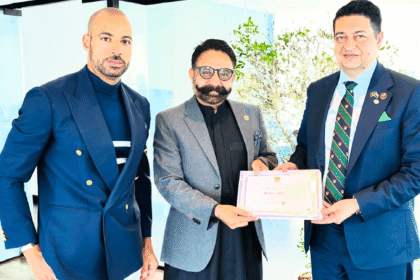

At last week’s Fortune Innovation Forum in Kuala Lumpur, Arun Pai, principal at Singapore-based Monk’s Hill Ventures, delivered a message that cut through the pessimism:

“Yes, we’re in a slump. But if you zoom out, things will work out quite well here in the long run.”

His remarks offer a rare, optimistic — yet grounded — perspective on the region’s tech future.

The Current Downturn: A Region Caught in the Global Tech Reset

The challenges facing Southeast Asia mirror those seen worldwide, but with regional nuances.

1. Funding Has Tightened Significantly

Venture capital inflows have fallen from pandemic-era highs. Mega-rounds are rare, seed deals are smaller, and investors are demanding clearer visibility into revenue and profitability.

2. Valuations Have Reset

Startups that once commanded outsized valuations driven by growth-at-all-costs narratives are now being forced to:

- Cut costs

- Pivot business models

- Delay expansion

- Focus on unit economics

3. Market Leaders Are Consolidating

Several unicorns and late-stage companies are merging, exiting markets, or restructuring, particularly in e-commerce, logistics, and fintech.

4. Global Macroeconomic Pressure

Slower growth in China, higher borrowing costs, and cautious global sentiment have hit investor confidence across emerging markets.

But according to Pai, these challenges are not signs of decay — they’re symptoms of a sector maturing.

Why Arun Pai Says the Future Is Still Bright

Pai’s outlook is rooted in deep regional experience. Monk’s Hill Ventures has been investing in Southeast Asia for over a decade, backing companies such as Ninja Van, Horangi, and ErudiFi. In his view, the slowdown is cyclical — not structural.

1. The Region’s Macro Fundamentals Are Still Strong

Southeast Asia remains one of the world’s most powerful long-term growth engines:

- Over 670 million people

- A young, digitally native population

- Rapidly expanding middle class

- Fast-growing digital consumption

- Government support for innovation and startups

Pai emphasized that these fundamentals “didn’t disappear just because valuations came down.”

2. Correcting Excesses Is Healthy

Tech expansions of the last five years created inflated valuations, inefficient spending, and unjustified growth expectations.

Pai argues that today’s reset:

- Forces discipline

- Rewards strong business models

- Eliminates weak players

- Sets the foundation for healthier long-term growth

A sustainable ecosystem requires these corrections.

3. Startup Talent Is Better Than Ever

Despite layoffs, the region now has a large pool of:

- Experienced engineers

- Product managers

- Founders with real startup experience

- Operators who have seen scaling challenges firsthand

This creates a stronger pipeline for second- and third-generation founders.

4. Investors With Patient Capital Are Leaning In

While global investors may be cautious, long-term VCs with regional roots — such as Monk’s Hill — see opportunity in lower valuations and higher-quality startups.

“Good companies are still getting funded,” Pai noted, “and this is one of the best times to build.”

Where the Next Wave of Innovation Will Come From

Pai highlighted several sectors where Southeast Asia is poised for breakout growth in the next decade:

1. Enterprise SaaS and B2B Tech

As SMEs digitize across Indonesia, Vietnam, and the Philippines, demand for workflow, payments, logistics, and HR tools is accelerating.

2. Fintech for Underserved Markets

With millions still underbanked or unbanked, opportunities in:

- Lending

- Micro-insurance

- SME finance

- Alternative credit scoring

remain enormous.

3. Climate and Energy Transition

From EV infrastructure to agritech and renewable energy solutions, the region is becoming a testbed for climate innovation.

4. AI Tailored for Emerging Markets

Smaller, localized, cost-efficient AI — not frontier mega-models — will dominate real adoption, especially in logistics, health, and government services.

5. Healthtech and Edtech

Digital services addressing real-life gaps across rural and urban populations continue to expand rapidly.

These are sectors with long-term secular demand, not speculative bubbles.

The Downturn Is Creating the Next Generation of Champions

One of Pai’s most compelling points at the forum was that downturns often birth stronger companies than booms.

Tough markets force founders to:

- Prioritize profitability

- Build lean teams

- Focus on real customer needs

- Avoid unsustainable growth strategies

The strongest startups built during downturns often become future industry leaders — a pattern seen globally after the dotcom crash and the 2008 recession.

“This is the moment when true builders emerge,” Pai said.

Why the Long-Term View Matters More Than Ever

The next few years will likely remain volatile:

- Funding cycles may fluctuate

- Regional political shifts may add uncertainty

- Global markets may continue to reset

But Pai’s message is clear:

Southeast Asia’s tech evolution is a 20-year story, not a quarter-by-quarter performance review.

The region’s demographics, digital adoption, and economic momentum make a powerful long-term case — one that short-term downturns cannot erase.

Conclusion: A Slump, Yes — But a Setup for the Next Great Phase

Southeast Asia’s tech industry is undergoing a painful but necessary correction. The hype has cooled, funding has slowed, and several high-flying companies have been humbled.

But beneath the surface, something more important is happening:

- The ecosystem is maturing

- Founders are getting sharper

- Investors are becoming disciplined

- Innovation is shifting from flashy to meaningful

As Arun Pai emphasized in Kuala Lumpur, the region’s long-term trajectory remains compelling — perhaps even more promising now that the excesses have been cleared.

Southeast Asia’s tech winter is real.

But the spring that follows may be even stronger.