In a move that has captured Wall Street’s attention, Nvidia CEO Jensen Huang has completed the sale of $1 billion worth of company shares, marking one of the largest insider stock transactions in the company’s history. The sale comes as Nvidia continues to dominate the artificial intelligence hardware market, riding the crest of an AI wave that has turned the semiconductor giant into one of the world’s most valuable companies.

The transaction, executed over several tranches in recent months, was part of a prearranged Rule 10b5-1 trading plan, designed to allow executives to sell shares without violating insider trading regulations. Yet the timing — amid record stock highs and an overheated AI investment cycle — has prompted speculation about what it means for Nvidia’s future growth trajectory and for Huang’s long-term intentions.

The $1 Trillion CEO and His $1 Billion Sale

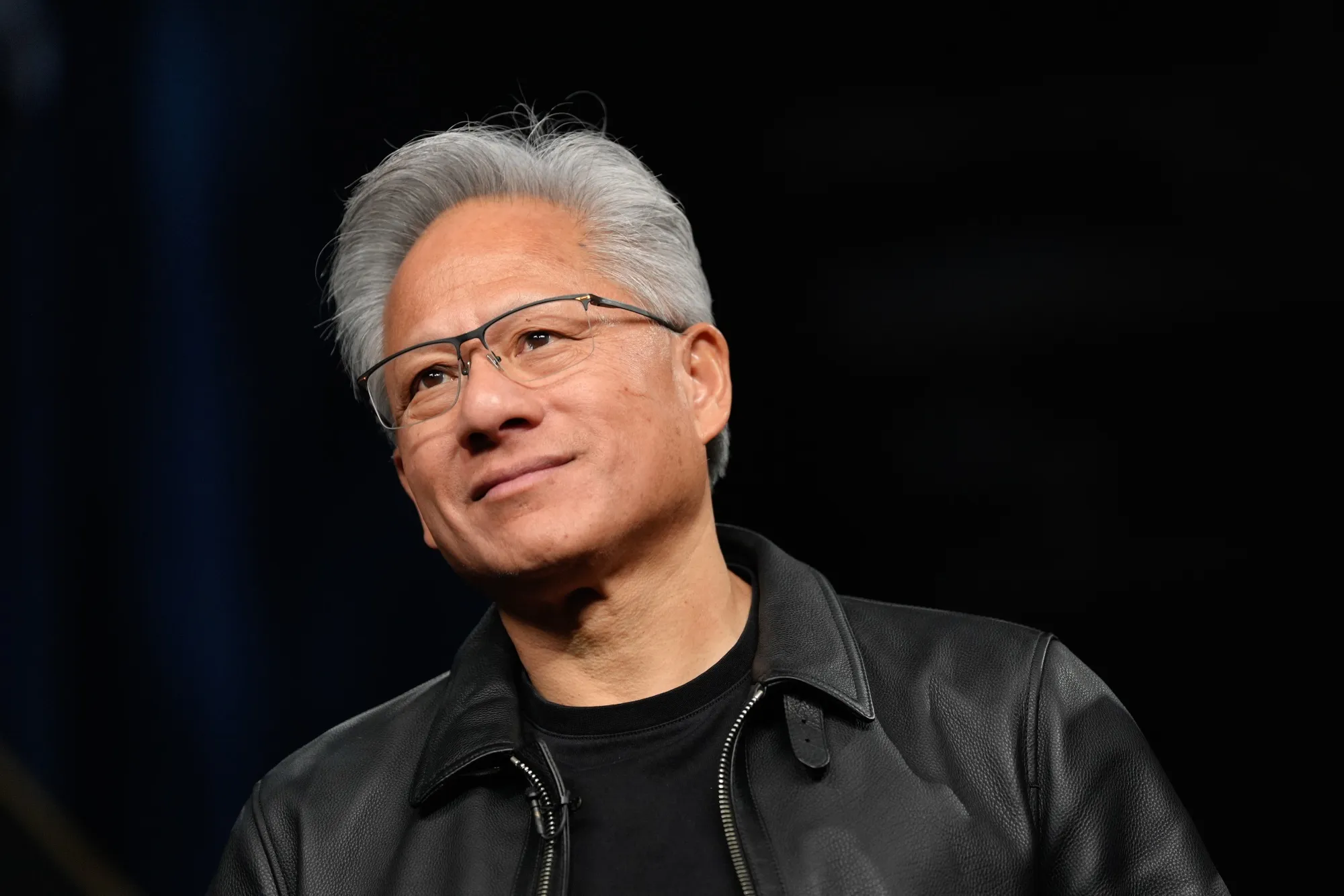

Huang, who co-founded Nvidia in 1993 and has led the company for over three decades, is one of the most recognizable figures in the tech industry. Under his leadership, Nvidia transformed from a niche graphics card manufacturer into the cornerstone of the AI revolution, supplying the chips that power everything from ChatGPT-like models to autonomous vehicles and data centers.

Nvidia’s market capitalization has surged past $3 trillion, making it the world’s second-most valuable company at various points this year, trailing only Apple. That meteoric rise has elevated Huang’s personal net worth above $80 billion, cementing his place among the world’s richest individuals.

The recent stock sale represents just over 1% of his total holdings, suggesting that while he is cashing out a substantial amount, his faith in the company’s long-term trajectory remains intact. Still, the sale’s scale has inevitably sparked discussions among investors about whether Nvidia’s astonishing rally — up nearly 200% over the past 18 months — might be approaching a plateau.

Riding the AI Gold Rush

Nvidia’s explosive growth has been fueled by insatiable global demand for its H100 and B200 AI chips, which are now considered essential infrastructure for building and training large-scale artificial intelligence systems. The company’s chips have become so vital to the AI supply chain that some analysts describe Nvidia as the “arms dealer of the AI age.”

Its clients include virtually every major tech player — from Microsoft, Amazon, and Google to OpenAI, Meta, and Tesla — all racing to build increasingly powerful AI models. As a result, Nvidia’s quarterly revenue and profit have shattered records, with gross margins approaching 75%.

The AI boom has also transformed the semiconductor sector’s perception among investors. Once viewed as a cyclical and capital-intensive business, it is now seen as a critical enabler of the world’s next major technological leap. Huang himself has described this era as “a new industrial revolution powered by accelerated computing.”

A Symbolic Sale, Not a Retreat

While billion-dollar insider stock sales often raise eyebrows, Huang’s move is more symbolic than strategic. Nvidia’s board and investors have emphasized that the sale was planned well in advance, part of a standard diversification strategy common among founders with concentrated equity positions.

Financial analysts say Huang’s decision to sell a fraction of his holdings likely reflects portfolio balancing and liquidity management, not a loss of confidence in Nvidia’s trajectory.

“After such extraordinary growth, it’s reasonable for executives to monetize part of their holdings,” said one investment strategist. “A $1 billion sale sounds dramatic, but in the context of Huang’s ownership stake and Nvidia’s valuation, it’s relatively modest.”

Moreover, the proceeds could be used for new ventures, philanthropic initiatives, or investment in next-generation technologies — areas where Huang has previously shown interest. He has long been an advocate for research in AI ethics, education, and semiconductor innovation.

Investor Sentiment and Market Reaction

Following the disclosure, Nvidia’s stock saw only a slight dip before stabilizing, reflecting strong investor confidence in both the company and its leadership. Traders appeared largely unfazed, viewing the sale as part of a normal insider trading cycle rather than a signal of peak valuation.

Wall Street remains overwhelmingly bullish. Analysts continue to raise price targets, citing Nvidia’s deep integration into global AI infrastructure and the lack of credible competitors in high-end GPU performance. Even as rivals like AMD and Intel race to catch up, Nvidia’s first-mover advantage and software ecosystem — including its CUDA platform — have entrenched its dominance.

Still, some investors caution that expectations are now so high that even minor disappointments could trigger volatility. “When a company’s valuation is this stretched, perfection is priced in,” one analyst noted. “At these levels, even a whisper of slower growth can cause a correction.”

The Broader Implications

Huang’s sale also underscores a broader trend among tech billionaires who have begun diversifying their wealth amid an era of unprecedented valuations. Executives at Amazon, Meta, and Tesla have all sold portions of their holdings recently, signaling a potential shift in how the ultra-wealthy are managing exposure to their companies’ skyrocketing stock prices.

In Huang’s case, however, his leadership remains deeply intertwined with Nvidia’s identity. Known for his hands-on approach, technical acumen, and signature leather jacket, he has built a cult-like following both inside and outside the company. His ability to bridge engineering and vision — from gaming GPUs to AI supercomputers — is widely regarded as the driving force behind Nvidia’s dominance.

Looking Ahead: Beyond the AI Boom

The question now is not whether Nvidia can sustain its dominance, but how far it can expand beyond AI training chips. The company has already set its sights on AI inference, robotics, networking, and even software platforms, seeking to build a comprehensive ecosystem around accelerated computing.

Meanwhile, governments around the world are courting Nvidia to build local chip ecosystems, underscoring the company’s strategic importance in both economic and geopolitical arenas.

As Huang diversifies his wealth, his company continues to diversify its empire. Whether the AI boom maintains its explosive pace or eventually cools, Nvidia remains positioned at the center of global technological transformation.

A Billion-Dollar Chapter in a Trillion-Dollar Story

Jensen Huang’s $1 billion stock sale is not an exit — it’s a milestone. It reflects the extraordinary value creation Nvidia has achieved under his leadership and the broader market’s recognition of AI’s central role in shaping the future.

For now, Huang remains as committed as ever to his vision of “accelerated computing for every industry.” And while he may have converted a portion of his paper wealth into tangible capital, his legacy — and Nvidia’s dominance — remain firmly embedded in the foundations of the AI age.