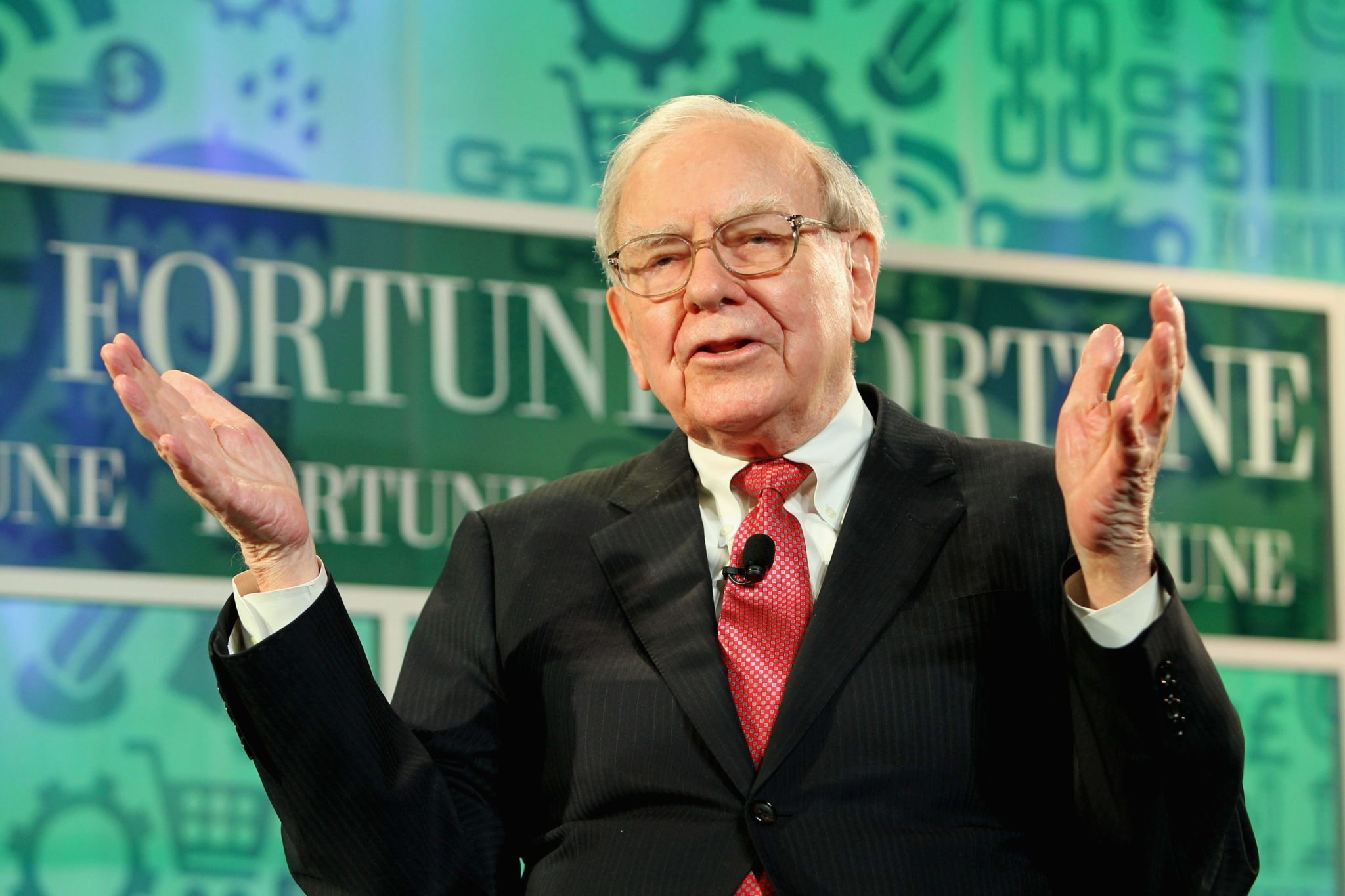

Warren Buffett’s Berkshire Hathaway has sold its remaining stake in BYD, the Chinese electric vehicle giant, bringing to an end a nearly two-decade investment that had once been hailed as a masterstroke in spotting the future of mobility. The divestment comes as BYD faces falling profits, slowing demand, and rising geopolitical uncertainty, particularly around tariffs that threaten China’s export-heavy EV industry.

A Historic Investment Comes to a Close

Berkshire first invested in BYD in 2008, acquiring nearly 10% of the company for about $230 million. At the time, Buffett’s top lieutenant, Charlie Munger, praised BYD’s founder, Wang Chuanfu, calling him a genius and betting that the company could become a leader in battery technology and electric vehicles.

That bet paid off handsomely. Over the years, BYD grew into one of the world’s top EV manufacturers, overtaking Tesla at times in unit sales and becoming a symbol of China’s dominance in clean energy technology. Berkshire’s stake swelled in value, at one point exceeding $8 billion.

But with the latest sale, Buffett has now completely exited BYD, signaling that the famed investor sees more risks than opportunities in the company’s future.

BYD’s Profit Pressures

The timing comes as BYD’s financial results show clear strains. The company recently reported weaker-than-expected profits, pressured by:

- Fierce domestic competition, with dozens of Chinese EV startups slashing prices to capture market share.

- Thin margins, as the “price war” triggered by Tesla in 2023 continues to ripple across the industry.

- High R&D and expansion costs, as BYD pushes into Europe, Southeast Asia, and Latin America.

While BYD remains the world’s largest EV seller by volume, its profitability has declined, raising concerns about how sustainable its growth model will be if margins continue to shrink.

Tariff Clouds on the Horizon

Another factor weighing on BYD—and likely on Buffett’s decision—is geopolitics. Western governments, particularly in the U.S. and Europe, are increasingly skeptical of Chinese EV imports.

- The European Union is investigating subsidies to Chinese EV makers, which could result in higher tariffs.

- The United States has already imposed stiff import duties on Chinese electric cars, effectively shutting BYD out of the American market.

- Growing U.S.–China trade tensions continue to create uncertainty around global supply chains.

Analysts warn that if protectionist policies expand, BYD’s global ambitions could be curtailed, significantly impacting its growth story.

Buffett’s Cautious Approach to EVs

Notably, Berkshire has never invested in Tesla, despite Elon Musk’s company being a longtime market leader in electric vehicles. Buffett and Munger both expressed skepticism about the auto industry, citing its history of intense competition and cyclical profitability.

BYD was the exception—an investment originally viewed as a bet on its battery expertise and potential to scale in China. But now, Buffett’s exit underscores his philosophy of selling when an industry shows signs of unsustainable competition.

“This is classic Buffett,” one market strategist said. “He rode the wave, made billions, and got out before the storm clouds became hurricanes.”

Market Reaction

News of Berkshire’s complete exit sent BYD shares lower, as investors saw it as both a symbolic and practical blow. Buffett’s name had carried enormous weight, and his endorsement was often cited as a validation of BYD’s long-term prospects.

“Losing Buffett is not just losing a shareholder—it’s losing an icon of credibility,” one Hong Kong-based analyst said.

What’s Next for BYD?

Despite the setback, BYD still holds major advantages:

- A massive domestic production base.

- A rapidly expanding footprint in emerging markets.

- Deep expertise in both EVs and battery manufacturing.

But it will need to prove that it can sustain profitability in a crowded field while also navigating rising global barriers.

For Buffett, the move marks the end of a long and profitable chapter—but also raises questions about whether he believes the golden era of Chinese EV expansion has peaked.

The Bigger Picture

Buffett’s departure also comes at a time when global investors are rethinking exposure to China amid slowing economic growth and unpredictable policy shifts. BYD’s struggles may be emblematic of broader challenges facing Chinese companies that are attempting to go global just as the geopolitical environment becomes more hostile.

In the end, Buffett’s exit may be less about BYD specifically and more about a warning to investors: EVs may be the future, but the road ahead will be anything but smooth.